Option Cap Floor Definition

They are most frequently taken out for periods of between 2 and 5 years although this can vary considerably.

Option cap floor definition. Capped options are a variation of vanilla call and put options. Un floor est un contrat de taux d intérêt qui moyennant le paiement d une prime permet à son acheteur de se couvrir ou de tirer profit d une baisse des taux monétaires en deçà d un certain niveau. It is a type of positive carry collar that is constructed by simultaneously purchasing and selling of out of the money calls and puts with the strike prices of which creating a band encircled by an upper and lower bound. In exchange for an option premium the buyer gains the right but.

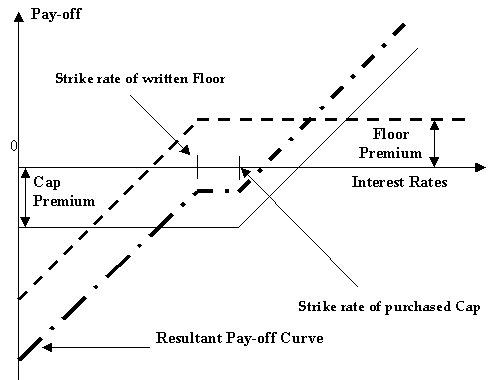

Caps and floors are based on interest rates and have multiple settlement dates a single data cap is a caplet and a single date floor is a floorlet. Buying a put option at strike price x called the floor selling a call option at strike price x a called the cap. Underlying risk reversal collar. These latter two are a short risk reversal position.

The premium income from selling the call reduces the cost of purchasing the put. A put option grants the right to the owner to sell some amount of the underlying security at a specified price on or before the option expires. A floor in finance may refer to several things including the lowest acceptable limit the lowest guaranteed limit or the physical space where trading occurs. A swaption swap option is the option to enter into an interest rate swap or some other type of swap.

The call and put options take on the role of caps and floors. Un cap est un contrat de gré à gré entre deux contreparties qui permet à son acheteur de se couvrir contre une hausse des taux d intérêt au delà d un niveau prédéterminé. Interest rate caps and floors are option like contracts which are customized and negotiated by two parties. An option based strategy that is designed to establish a costless position and secure a return.

Interest rate floors are utilized in derivative.

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)