Other Deductions Not Subject To The 2 Floor

Thus you should not need to make additional entries as other current year decreases.

Other deductions not subject to the 2 floor. Certain of these expenses are not deductible unless in aggregate they exceed two percent of the taxpayer s adjusted gross income. For tax years previous to 2018 if you itemize your deductions part of the expenses that you claim as deductions may be limited by the 2 rule deductions that are included are unreimbursed employee expenses expenses. This is easier to do if the fees are charged on an hourly basis and description of time spent is included. These porfolio deductions are not subject to the 2 floor.

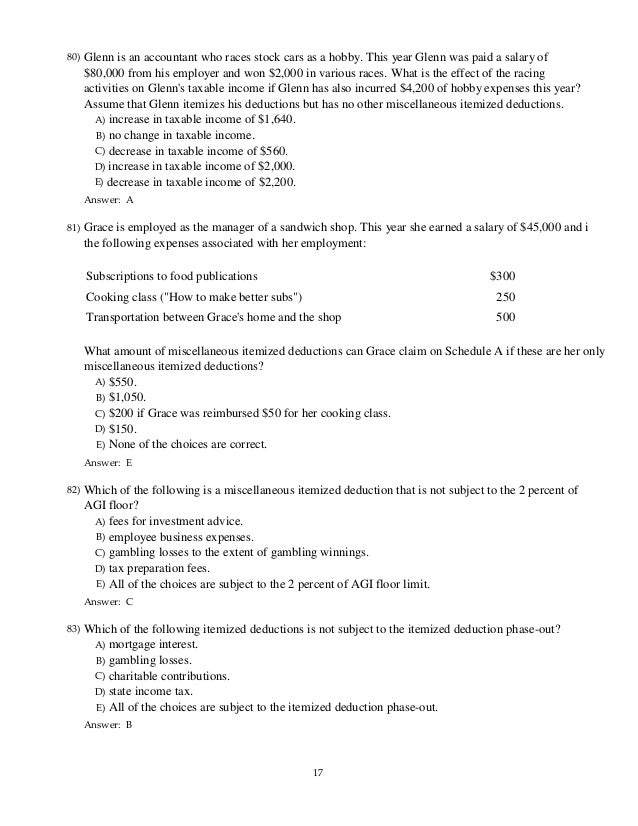

Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation. In prior years amounts subject to the 2 floor on line 13 of sch k 1 would have been coded with a k. As of the 2018 tax year itemized deductions for job related expenses or other miscellaneous expenses outlined below that exceeded 2 of your income have been suspended. There are two types of miscellaneous deductions.

This code has been deleted. Bundled fees like trustee or executor commissions attorneys fees or accountants fees need to be allocated between deductions subject to the 2 floor and deductions not subject to the 2 floor. This code has been deleted. You can deduct a casualty or theft loss as a miscellaneous itemized deduction not subject to the 2 limit if the damaged or stolen property was income producing property property held for investment such as stocks notes bonds gold silver vacant lots and works of art.

Miscellaneous deductions are deductions that do not fit into other categories of the tax code. You can still claim certain expenses as itemized deductions on schedule a form 1040 1040 sr or 1040 nr or as an adjustment to income on form 1040 or 1040 sr. There are many expenses that may fall under this category of deductions including the following. Investors can still deduct the interest they pay on investment assets for.

There are other possible ways to. However deductions under section 67 e 1 continue to be deductible if they are costs that are incurred in connection with the administration of an estate or a non grantor trust that would not have been incurred if the property were. Miscellaneous itemized deductions subject to the 2 floor aren t deductible for tax years 2018 through 2025. Present law individuals may claim itemized deductions for certain miscellaneous expenses.

These porfolio deductions are not subject to the 2 floor. Appraisal fees for a casualty loss or charitable contribution. 1 deductions subject to the 2 limit these deductions allow you to deduct only the amount of expense that is over 2 of your adjusted gross income or agi. In prior years amounts subject to the 2 floor on line 13 of sch k 1 would have been coded with a k.

First report the loss in section b of form 4684.